Robo Tracker

InvestSuite and Franklin Templeton join forces to launch a new robo-advisory solution.

We have teamed up with Franklin Templeton, one of the world’s largest independent asset managers, to introduce a new B2B robo-advisory solution to the market. The joint offering aims to enhance automated goal-based investing by combining Franklin Templeton's award-winning AI-driven goal-based engine with the behavioral engagement platform that is our Robo Advisor. This joint offering is the first step in a long-term partnership.

The investment landscape is evolving rapidly. The appearance of various digital investment platforms indicates a structural evolution in investment advice driven by technology, which is proving to be a very cost-efficient way to offer personalized investment advice in a scalable manner.

The future is AI-driven goal-based investing

Together, we bring automated goal-based investing to a new level. Our joint offering blends the deep investment expertise and AI/ML capabilities of Franklin Templeton with our behavioral engagement platform.

This new robo-advisory offering empowers investors to achieve financial goals while providing a unique tracking/coaching experience. It offers a human-centric experience for automated investing and engages today's investors in a long-term digital investment journey.

Powered by a dynamic engine

The concept of goal-based investing has been around for some time, but the effective implementation is relatively new. Based on award-winning research, Franklin Templeton created a distinguishing implementation methodology for optimizing the probability of reaching goals.

The engine optimizes directly in function of investors' goals, with a dynamic goal path consisting of investment portfolio allocations, directly tied into the goals. At any point in time, the engine can indicate the probability of reaching goals and adjust the goal paths accordingly. When needed, actionable recommendations are provided to get back on track and continue a successful goal pursuit.

On top of this dynamic engine, we created a simple and easy to understand coaching experience, with behavioral features, similar to the guidance of an actual, physical investment advisor.

Franklin Templeton & InvestSuite, a perfect match

We have joined forces with Franklin Templeton to create a better investment experience. Thanks to this cooperation, Franklin Templeton can unlock innovative features for all of their clients.

Robo Tracker - Personalized goal-based investing for the mass market.

Today’s investors increasingly want to decide for themselves how their money is invested - even if they lack financial literacy - and look for automated digital platforms which offer a guided and personalized experience. Investors desiring to achieve concrete and quantified goals are looking for support in pursuing and staying on track of those goals. The question is, how can such a mass of investors be served at scale?

Launch your own Robo Advisor and remain your customers’ trusted go-to financial partner. Unlock the potential of an attractive investment platform that offers personalized portfolios, easy-to-understand

investments, profitably managed at a low cost - anytime and with full transparency.

Don’t let excessive development costs, long time-to-market or lack of expertise hold you back. Trust our Robo Tracker to launch your own robo advisor for a truly goal-based investment experience!

The white-label robo advisor that helps you win the mass investor

Robo Tracker is a highly configurable automated investing platform that guides investors towards concrete goals. This Robo Advisor is enriched with Franklin Templeton’s award-winning algorithm for goal-based investing and is designed to track and coach investors to reach financial targets on time and in line with their personal priorities.

The white-label solution provides goal-based investing with personalized portfolios and is set up for the best customer experience. The portfolio construction engine is powered by sophisticated algorithms that incorporate the investor’s investment preferences and risk profile. The scalable solution masters the construction and rebalancing of a large number of individual portfolios. A turnkey solution that gets you to market in a fraction of the time and at a fraction of the cost of an in-house build.

Grow AUM

Appeal to a wider range of investors with the objective to optimize the probability of reaching investment goals and capitalize on the growing demand for automated investing. Attract new customer segments and retain loyal clients, ultimately growing your AUM.

Cost savings & increased efficiency

Highly scalable algorithm-based automation of portfolios delivers personalization at scale in combination

with a unique tracking and coaching experience to customers across the wealth curve (retail, mass affluent

and high net worth) and drives down your operational cost. Serve investors at scale more quickly, accurately and efficiently.

Enhance existing services

Complement your existing advisory services with automated investments. Offer convenience: a digital investment platform that is accessible 24/7 from anywhere - on mobile and web.

Hybrid

Apply different levels of advice and differentiate your investment service between segments. Monitor the performance of automated portfolios, assist clients in pursuing personal financial goals and help prevent them from falling short of their goals.

Launch your own Robo Advisor

Start a human-centric experience for automated investing and engage today’s investor in a long-term digital investment journey.

Launch your own Robo Advisor

Launch your own Robo Advisor

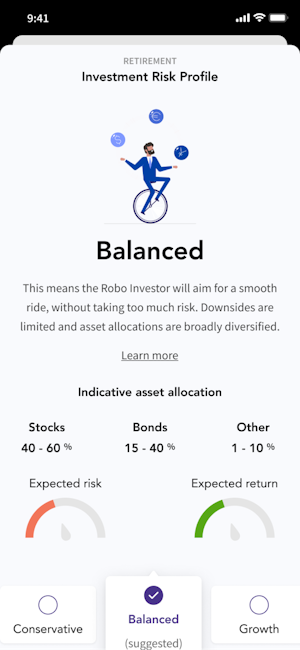

Discovery

Built into the white-label front-end is an intuitive onboarding experience with powerful re-engagement functionalities. Through personas, customers can first explore the automated investing experience. Virtual portfolios re-engage the investors that have passed the risk profiler but are not yet ready to invest, allowing them to follow up on a real-time virtual portfolio as if their money was invested for real. Easy to fund later on and thus convert into a real invested portfolio.

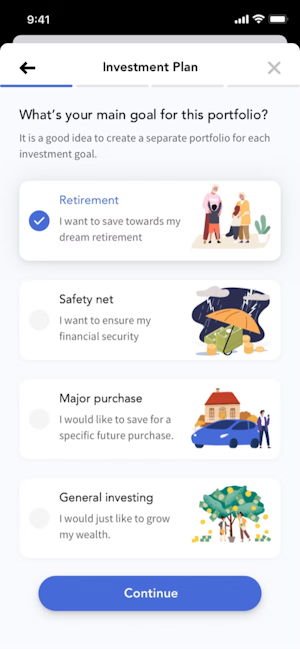

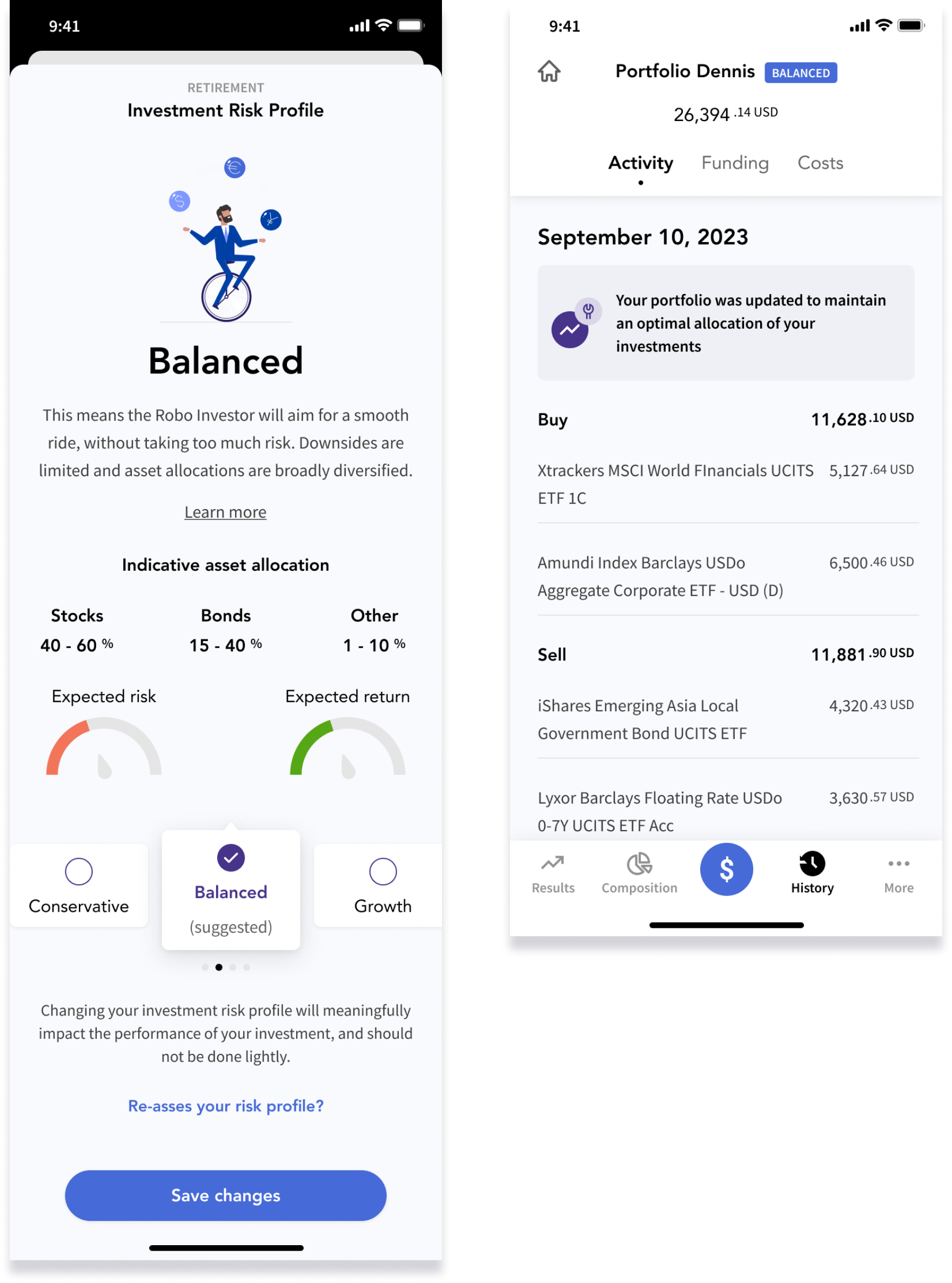

Set goals, assess preferences and risk tolerance

A dynamic and intuitive step-by-step journey guides investors to set financial goals and saving objectives - assessing their position on the risk spectrum, as well as understanding their specific personal preferences.

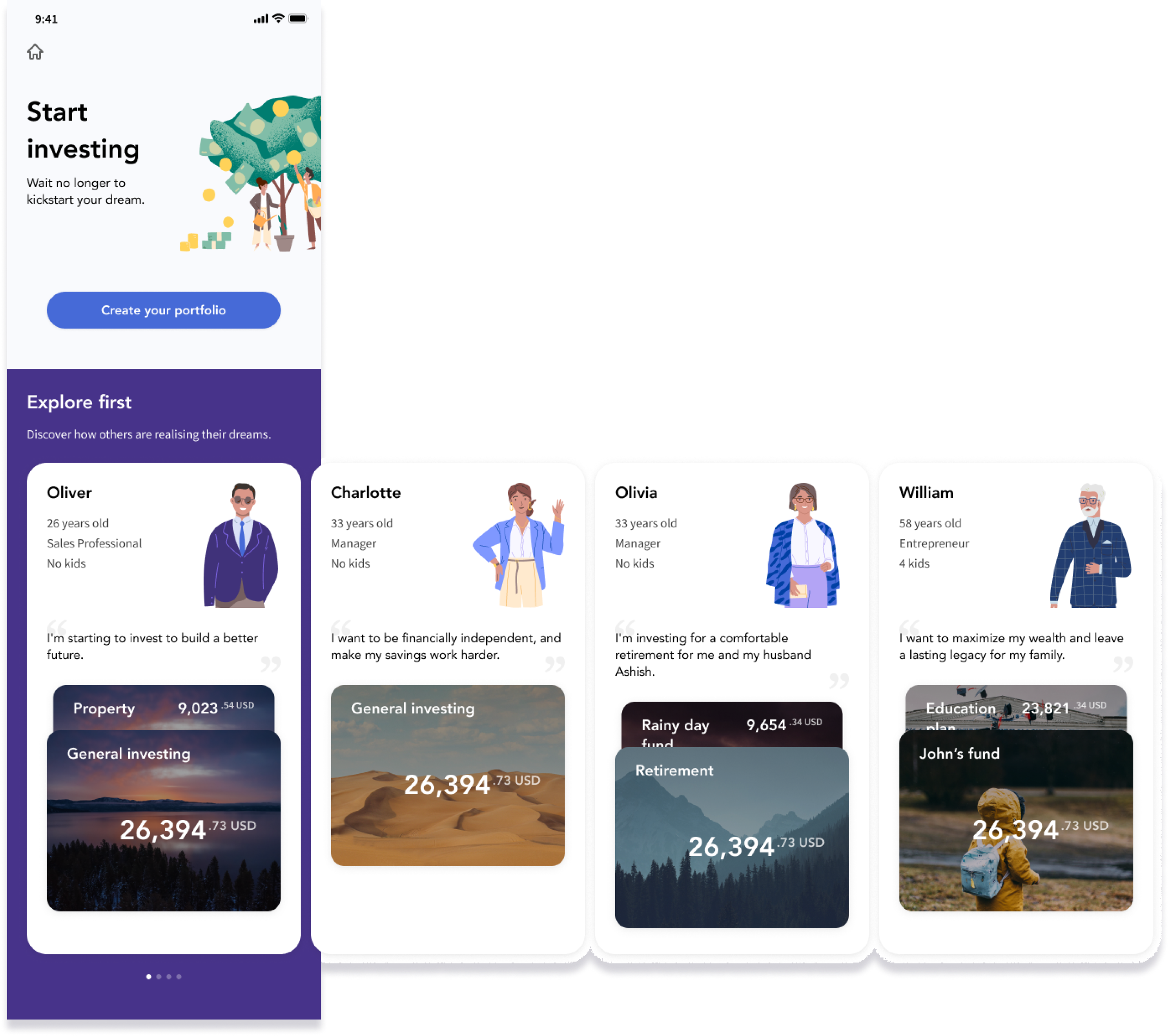

An individual proposal: a personalized portfolio, dynamically rebalanced

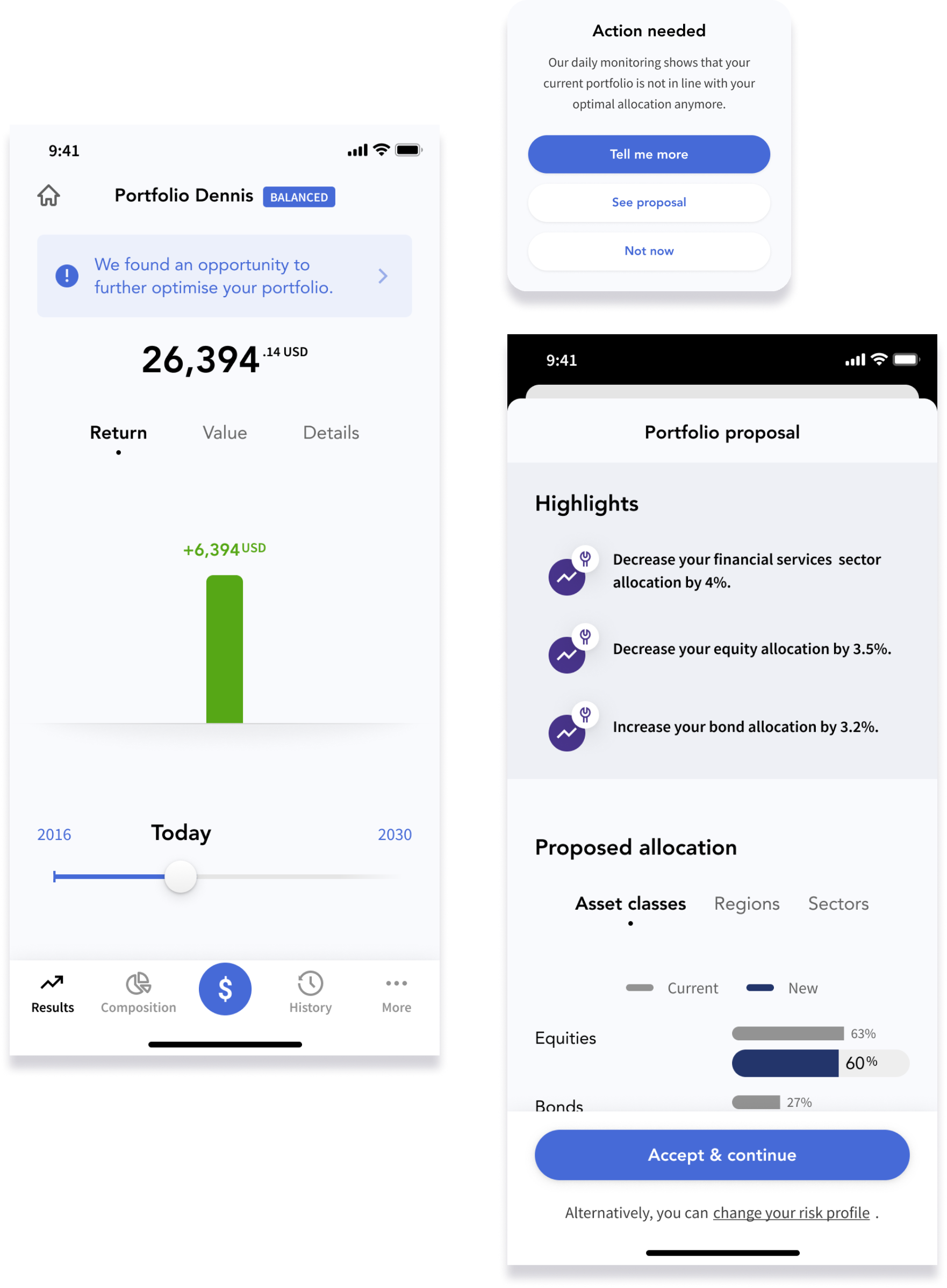

Create personalized investment portfolio proposals - per investor and per investor goal - in line with preferences and risk profile. All portfolios are dynamically rebalanced to ensure compliance with the defined investment policy.

UX, behavioral design, insights and transparency at the core

A “humanized” Robo Advisor leveraged by easy but sophisticated user experience provides guidance and encourages responsible investment behaviors. It offers the functionality to invest more or withdraw at any time, and easily manages monthly or one-off contributions. It displays projections of potential future performance and returns, provide details on rebalancing reasons and portfolio composition, and offers transparency on costs.

Concrete goals

Help investors solidify their goals by allowing them to set a specific target amount that they want to achieve in a given period, taking into account the priority the goal has for them.

Dynamically support and coach goal pursuit

Optimize portfolios for investors’ goals, adjust to the goal pursuit and respond to the actual investing behavior of the investor. Keep the immense complexity of the algorithms entirely under the hood and allow investors to enjoy simplicity.

Eyes on the probability

Allow investors to identify how essential a goal is to them. This results in setting the goal optimization algorithm to pursue a higher level of probability to successfully achieve that specific, most essential goal.

Track efficiently

Coach investors to stay on track of their committed goals via a fully automated yet intuitive coaching experience:

- Provide gradual transition to displaying off track stages and empower investors to get back on track at their own pace.

- Suggest actionable recommendations for investors to get back on track towards their goal.

- Keep investors aware when goals are tending towards going off track.

- Engage your investors to stay committed by nudging to better investing behaviors.