Strengthen and grow a traditional business model with digital wealth management.

Most wealth managers are proud of their existing investment approach and expertise. Yet costs and margins are under severe downwards pressure, which is driving the industry-wide challenge to systematically transform and modernise existing business models to remain profitable.

New clients – younger people that might inherit family assets for example – have different expectations of the service they receive. They are increasingly demanding and expect to be able to find information about their investments in a fully digital way. So how do private banks and wealth managers develop digital solutions to retain these clients, while avoiding excessive investment in proprietary systems and keeping up that crucial element of personal service?

InvestSuite’s range of digital tools has been designed to help private wealth firms to build on existing expertise and processes, and deliver the next-generation services that will help set them apart.

Discover our Product Suite

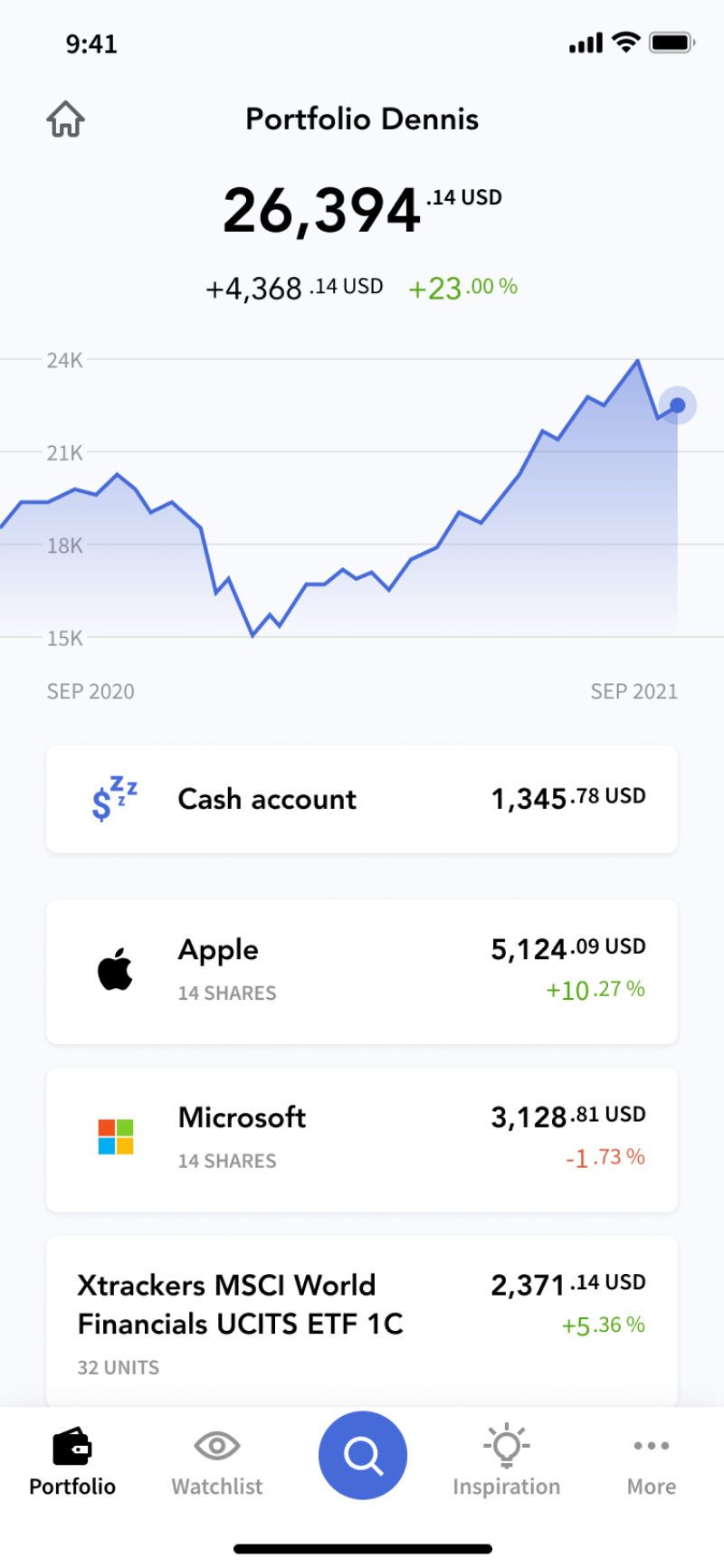

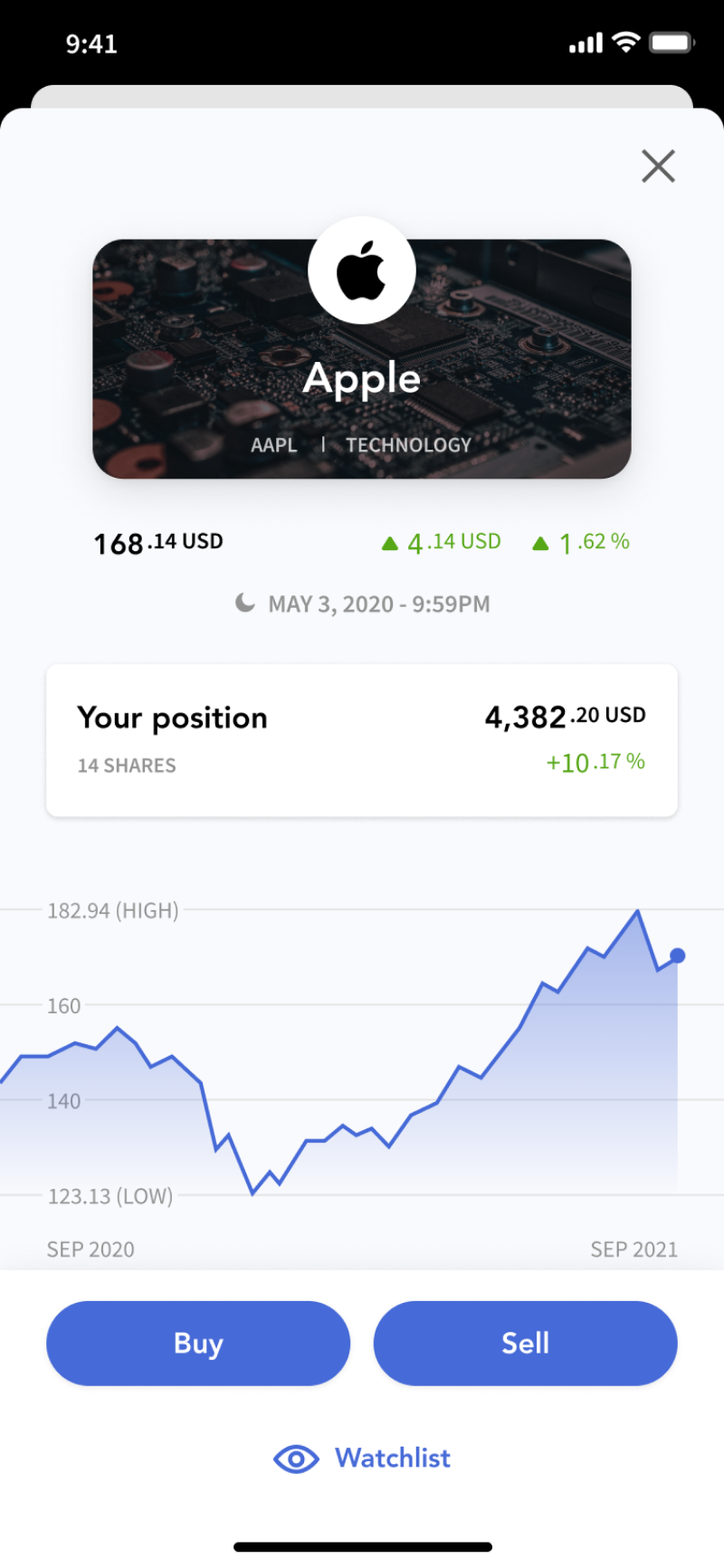

Self Investor

It enables clients to manage a part of their portfolio in a self-execution setup. It allows them to research and trade investments themselves for that part of their portfolio, while the private banker/relationship manager gets automatically informed, providing touch point opportunities.

StoryTeller

Story Teller helps wealth managers calculate and report investment performance to end investors in a fully personalised way, using relatable, understandable language. It analyses the drivers of investment performance thanks to state-of-the-art performance attribution and news aggregation algorithms and outputs the results in an intuitive, fully personalised and automatically generated report.

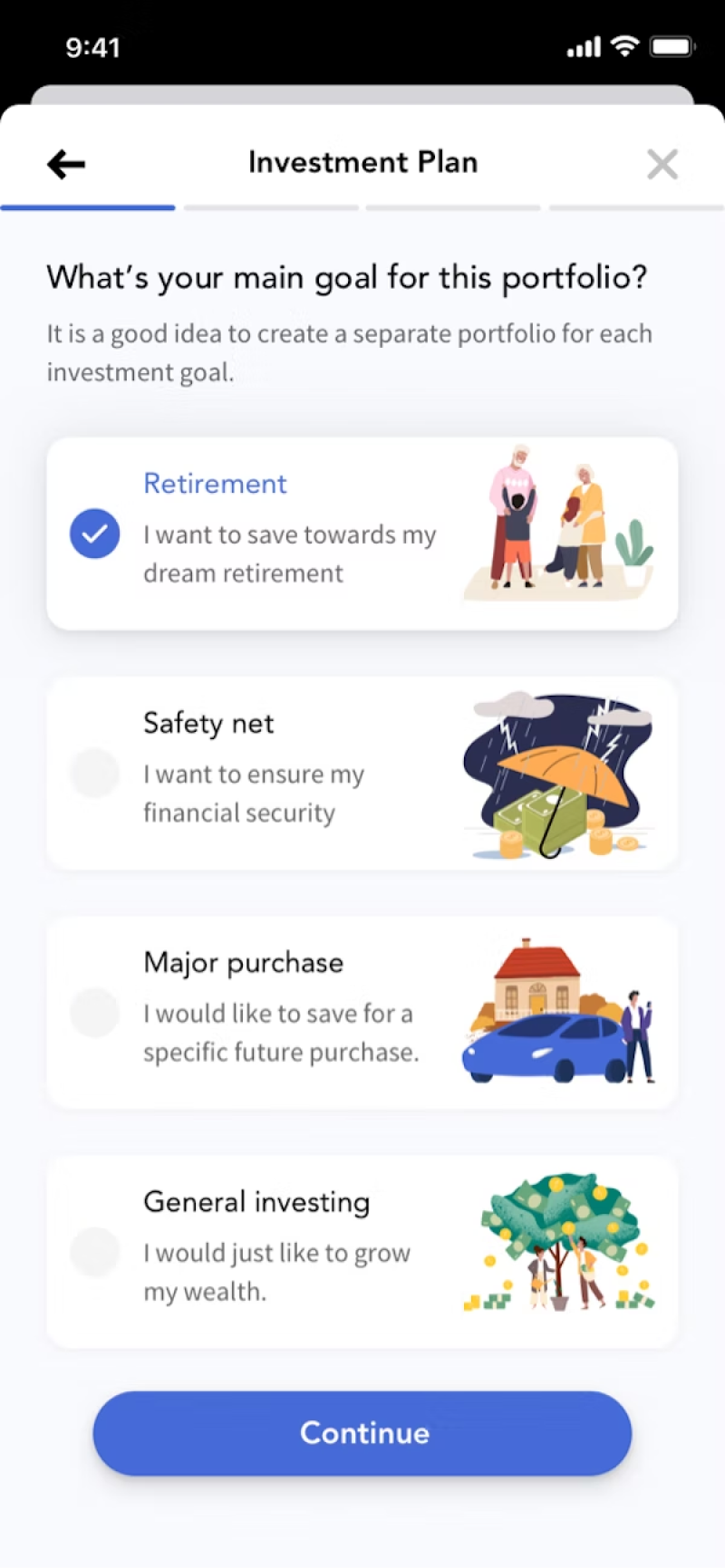

Robo Advisor

It provides Mifid-compliant onboarding and risk profiling, along with portfolio reporting and rebalancing. It is fully customisable at the front end and can be used with your own or third-party funds. It even provides options for fully personalised portfolio construction.

StoryTeller

On-demand, hyper-personalised and narrative-based portfolio performance reporting. Discover more

Robo Advisor

A highly configurable automated investing platform that delivers hyper-personalised portfolios for goal-based investing. Discover more