Up to now, most challenger banks have mainly been focusing on payment and financial planning solutions. While this is a great way of gathering customers, the profitability of these services is generally low.

A logical next step is for challenger banks to consider distributing investment products as a source of additional income. However, developing proprietary investment solutions is very time-consuming and expensive. Furthermore, many challenger banks lack the investment know-how to build state-of-the-art solutions themselves.

InvestSuite provides a wide range of white-label, intuitive digital investment tools that are easy to integrate with your existing systems and are specifically targeted at less experienced retail investors. They can help you open up new revenue streams in a matter of months, instead of years.

Discover our Product Suite

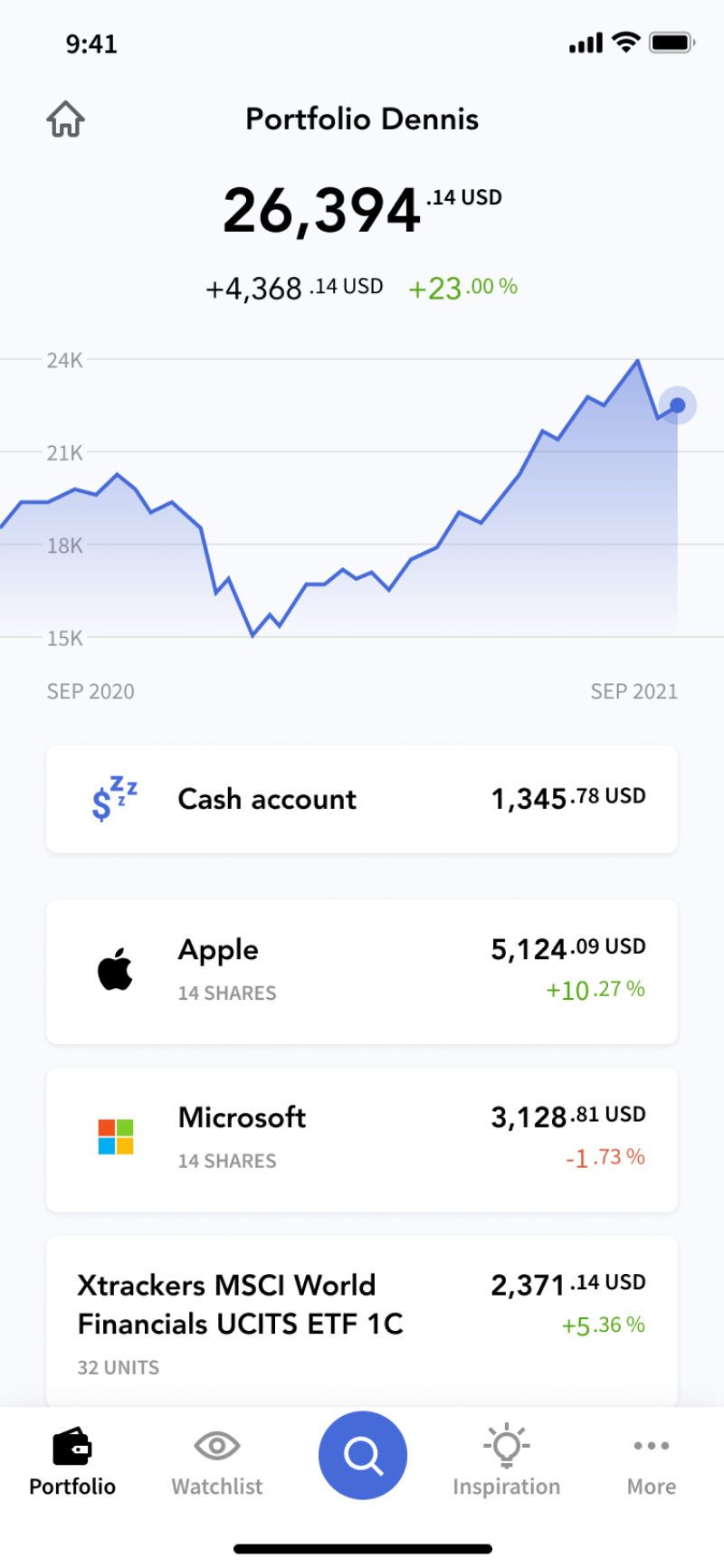

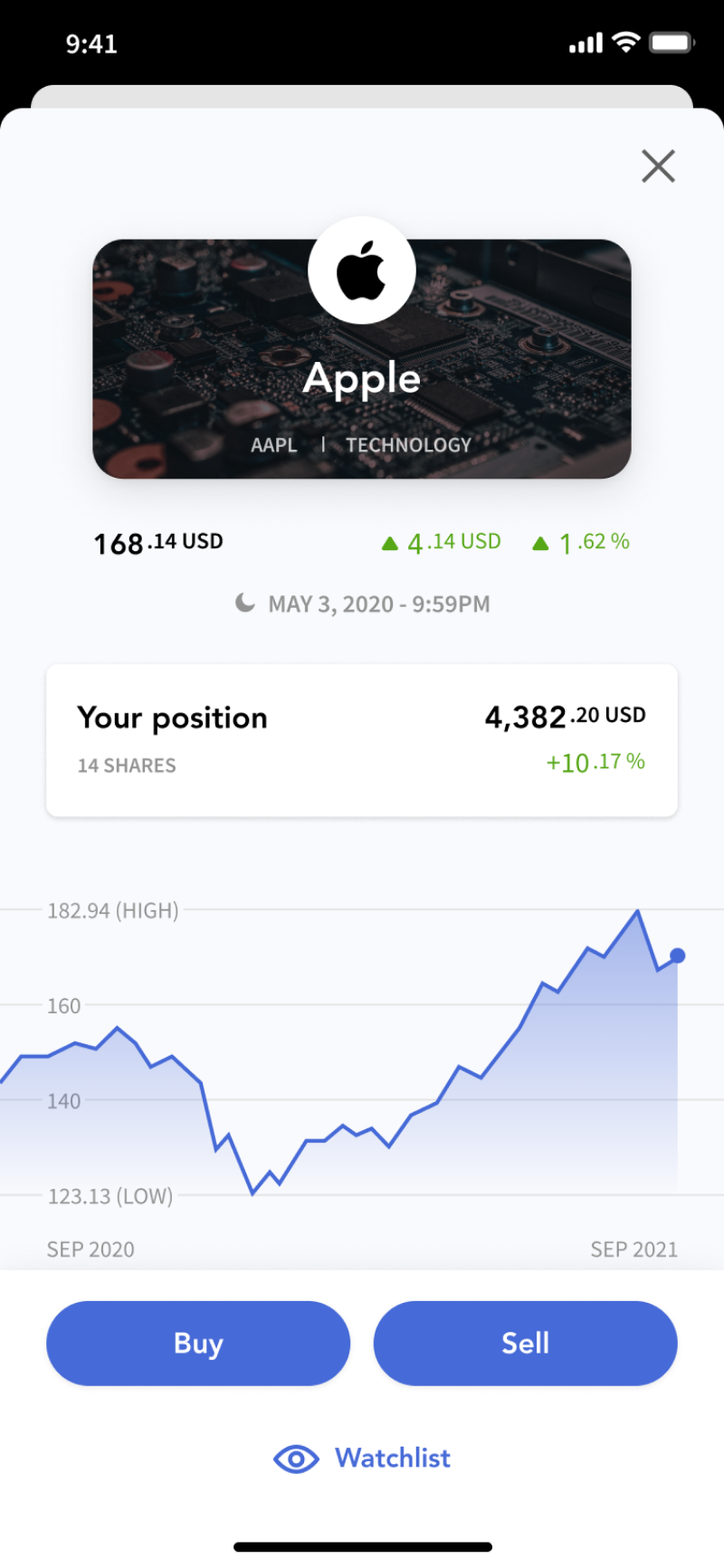

Self Investor

It enables both first-time and more experienced investors to gather sufficient information and guidance to be able to manage their investment portfolios themselves.

Robo Advisor

It combines intuitive UX/UI and regulatory compliant onboarding with state-of-the-art portfolio construction, reporting and rebalancing. It is an API-based, multi-device solution, designed for seamless integration into core banking/back-end systems. The service can be used in an advisory or discretionary setting.

StoryTeller

It analyses the drivers of investment performance thanks to state-of-the-art performance attribution and news aggregation algorithms and outputs the results in an intuitive, fully personalised and automatically generated report.

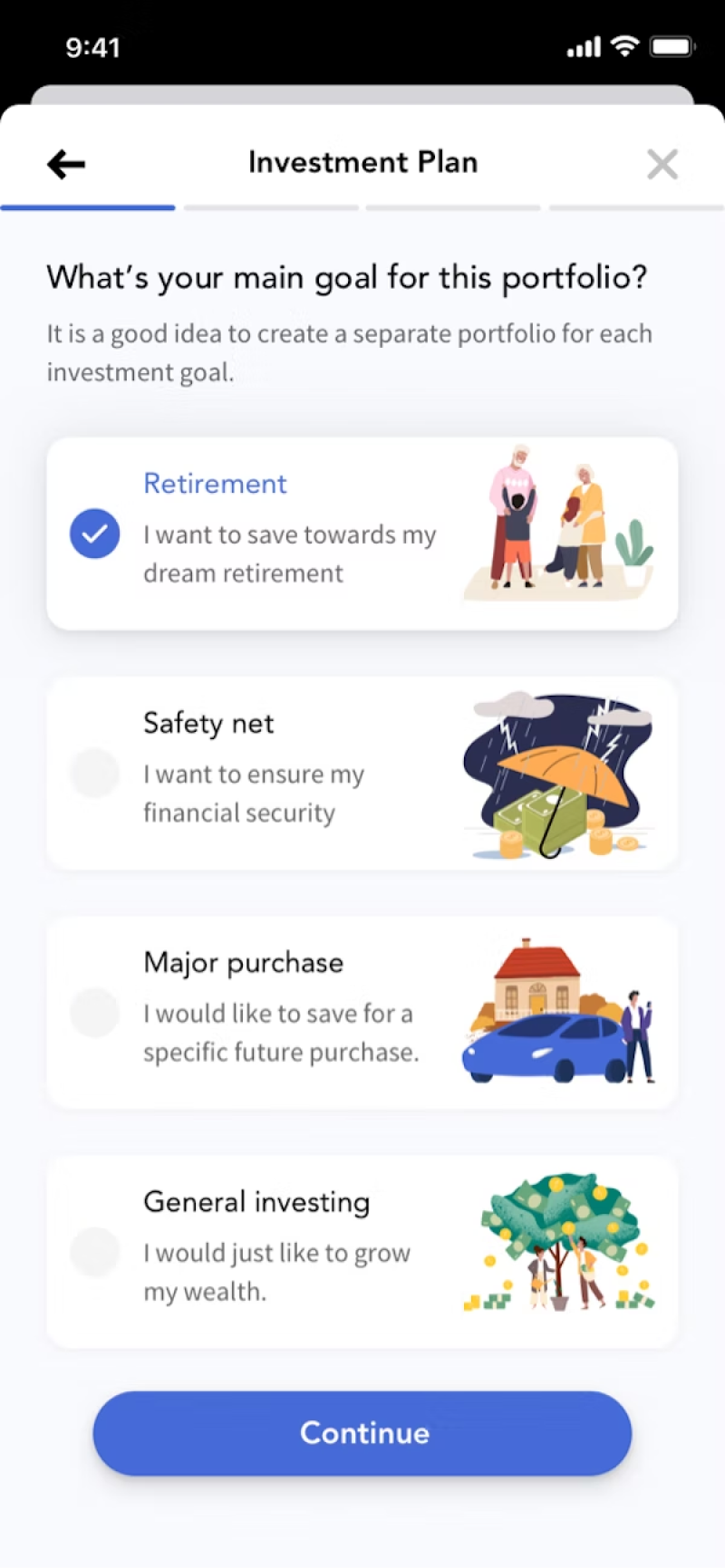

Robo Advisor

A highly configurable automated investing platform that delivers hyper-personalised portfolios for goal-based investing. Discover more

StoryTeller

On-demand, hyper-personalised and narrative-based portfolio performance reporting. Discover more